eGovernment - Family 500+ Project with Credit Agricole

FAMILY 500+

EXIMEE PLATFORM

NEXT STEPS

In 2016, the Polish government launched a publicly available Family 500+ program, under which each family received monthly financial aid of around EUR 150 (PLN 500) per child. In order to receive this benefit, it was enough to submit an application. The program covered the whole country. In 2017, a year after the launch of the program, almost 4 million children received such aid.

What did you have to join the Family 500+ program? What role in this story did banks play?

One of the banks that has been participating in the Family 500+ program since its inception is Credit Agricole. We discussed the above questions with Tomasz Hajdasz, the Director of Software Development Department at Credit Agricole.

Let's start with briefly describing how the process of applying to join the Family 500+ program was organized.

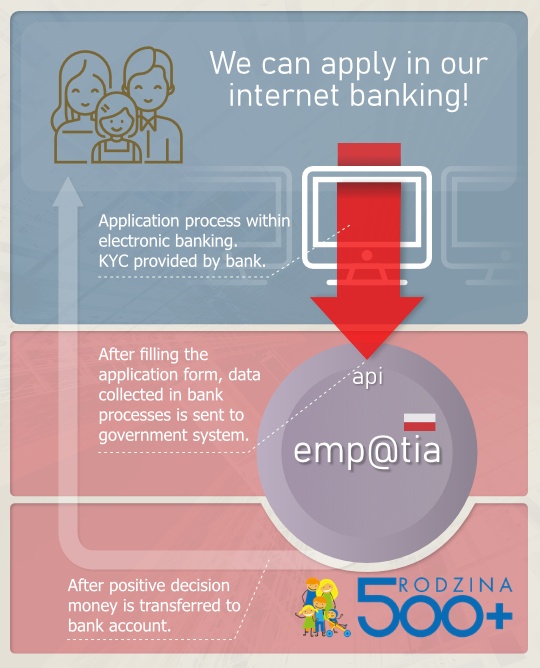

In order to enable parents to apply for this benefit in an efficient way, Polish government decided to use existing e-banking systems of banks operating in Poland to let people apply for benefits through them. Why in this way? Well, such an approach had some undeniable advantages.

Firstly, the identity of the applicant was not questionable, as it was undisputedly confirmed by a bank.

Secondly, an important element making it easier for customers to submit an application was the fact that customer data were already known to the bank - so it wasn't necessary to type them in the electronic form manually. There was also no problem with entering bank account number to which the benefit was to be transferred. The bank provided the customer with a list of accounts - all it took was to select one of them.

Finally, the third element was the decentralization of application submission by spreading the application process among many banks operating in Poland. Moreover, for these banks, the launch of application processing was a benefit too - because it was the accounts in these very banks that were to receive customer funds.

And for many people, joining the 500+ program was the motivation to open an account in a given bank in the first place.

Therefore, it was not necessary to build a governmental system enabling the filling in of the application. However, it was necessary for the government to create a central system to receive applications submitted from banking systems - and such a system was created. It is called emp@tia ("empathy") - it is an API through which banks send electronic applications.

And how did the banks have to prepare themselves to join the Family 500+ ? What was their role?

The main expectation towards banks was to efficiently guide customers through the process of applying and then to send the collected electronic forms to the emp@tia government system.

First of all, it was necessary to develop an interface to the API of this system. Secondly, the customers had to be provided with a process (application) consisting of several steps, integrated with the banking system. During this process, customers could enter all the data necessary to receive the benefit. Thirdly and finally, the application should be embedded in e-banking and - which is crucial for the CX-value - consistent with the existing banking system in the sense of customer journey.

From a technical point of view, it was also necessary to protect the collected data against the unavailability or other temporal problems of the government's emp@tia system.

It is also worth noting that the elements described above were necessary in all banks joining the program - therefore, each of the banks had to do exactly the same work.

And there was not much time to do it. There were only a few months between the announcement of the program guidelines and the date of its launch. An additional difficulty, however, was the fact that the government's emp@tia system was developed during exactly the same few months.

Obviously banks had to put some effort into participating in the program. For Credit Agricole, what was the main reason for joining the Family 500+ program?

Actually, the decision was obvious from the very beginning and was directly related to our values - we want to be the most people-oriented bank in Poland. Therefore, every initiative that makes our clients' lives easier becomes our goal.

Why did you decide, despite having your own software development department, to use an out-of-the-box solution?

This decision was a sum of several factors. First of all, we had already launched several internal projects. Within such a short time imposed by the government, we would have had to stop some of them and postpone them, which would disrupt our publishing process. We did not want to do this. Secondly, we would have had not only to integrate our systems with emp@tia but also to constantly monitor the changes in its API on an ongoing basis. Meanwhile, the ready-made solution - I'm talking about your eximee platform - was practically at our fingertips and it was enough to reach for it. Moreover, at that time we had development of other processes on our horizon, so the platform enabling such development was an interesting proposition for us.

Exactly, just one year after you had joined the Family 500+ program, you decided to launch new sales processes on eximee. But on the other hand Credit Agricole's strategy has always been to develop such processes by themselves.

That is correct. We are not the largest bank in Poland, but we want to be one of the most modern. Not without significance was the fact that at that time we had been using your platform for some time - i.e. since the launch of the Family 500+. All it took was to put new processes in it. Having a development team, we decided to create some of them on our own. We built up the competences that enabled us to do so - in many sales channels at the same time. I can proudly say that at the moment we have launched credit applications integrated with e-commerce and also a cash loan fully online in mobile and desktop internet banking, as well as several smaller applications, such as a contact form or a request for account transfer process.

The Family 500+ project was implemented by Consdata in 7 banks - Santander (then BZWBK Bank Polski), mBank, Credit Agricole, Eurobank, among others. The project was successfully completed in less than 3 months.

Tomasz Hajdasz was interviewed by:

Consdata Sp. z o.o.

ul. Bolesława Krysiewicza 9/14

61-825 Poznań

Polska

tel. +48 61 41 51 000

email: sales@consdata.com

Tomasz Ampuła

Product Owner, Digital Transformation Expert

tel. +48 783 211 611

email: tampula@consdata.com