Effective business decisions derive from reliable feedback from customers. Bank Zachodni WBK (Santander Group) has been provided with a convenient and straightforward tool for collecting feedback concerning its services, thanks to an innovative project pursued by Consdata.

Problem

The project was designed to allow the bank to reach out to a wide variety of customers with a view to exploring their expectations, problems, opinions and comments as regards the range of financial products offered and the quality of services.

Before the implementation of this project, customers were only able to provide feedback by phone or in the form of a written complaint. Thus, the feedback from bank customers could not be collected in a form that could be easily analysed.

Solution

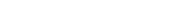

Consdata implemented a tool for centralised survey management at BZ WBK – whereby forms may be defined, in this way surveys may be launched to focus on different channels (e-banking, internet requests), and results may be collected and examined.

Surveys are created using an intuitively based and easy-to-use editor. The editor makes it easy to “customise” forms on request, including a flexible choice of the possible types of answers (for example; 1-10 scale, multiple answers, single answer, open question, etc.).

Survey distribution

This solution facilitates the distribution of surveys among customers. Once developed, a survey may be attached to online applications. The conditions under which the survey is to appear in the application may also be defined - for instance, after the completion of an application for randomly selected clients.

The tool has also been integrated with “Poczta 2.0”, a modern communication platform, already implemented in the bank by Consdata. “Poczta 2.0” is a back office application that enables bank employees to manage their communication with individual clients easily and conveniently.

Thanks to their integration with “Poczta”, surveys may be sent to customers in the same way as other electronic mail (such us tariffs and fees). The relevant survey may be sent to a specific target group.

Recipients are notified of the receipt of a survey in the same way as they are notified in the event of the arrival of other messages. They may easily fill out and return the form.

Survey results

A single survey may reach several million customers at the same time. Thanks to the option of easy access to so many customers at once, the bank may obtain access to more extensive data than ever before. However, since surveys may also be targeted precisely to specific groups, individual customers never have to view surveys about topics that do not pertain to them.

The customer may complete the survey only once, which ensures transparency in communication and guarantees “unbiased” data for the bank.

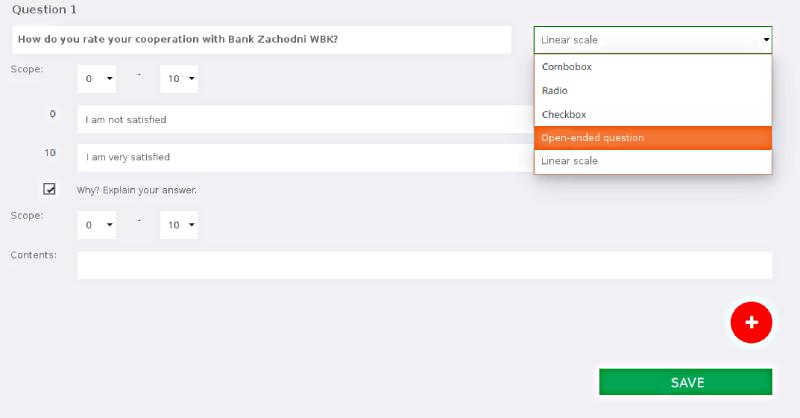

Bank employees may keep track of customer feedback via back office applications. Aggregated survey results are presented in visually attractive diagrams (for example pie charts, bar charts), facilitating their easy examination and interpretation. Detailed responses may also be exported.

Customers benefits

Thanks to the implemented solution, the bank may easily obtain feedback concerning services or quality of service and examine the results. Accordingly, the bank has the potential to tailor the portfolio of its services to the needs of its customers or respond to their problems in a considerably shorter timeframe. Thus the bank may achieve sales goals more effectively.

The solution will also benefit the customer. The customer has been provided with an opportunity to express their opinion concerning the quality of services or bank products in a quick and user-friendly manner. The customer may conveniently and easily complete the survey while enjoying access to electronic banking or mobile application, or on the occasion of application submission.