Let's start with calling a spade a spade: every abandoned customer application in your online banking is a loss of your money (a smaller profit), but also a loss of your bank's reputation. In developed and developing economies there is probably no longer a man without a bank account. The customer, regardless of the circumstances, will win anyway - that is, he will go to the bank to get a specific product and finally he will have it. Maybe he will choose your competitor's offer, maybe not. However, if so, your bank will be remembered negatively in his eyes due to various problems that occurred while filling in the online application form.

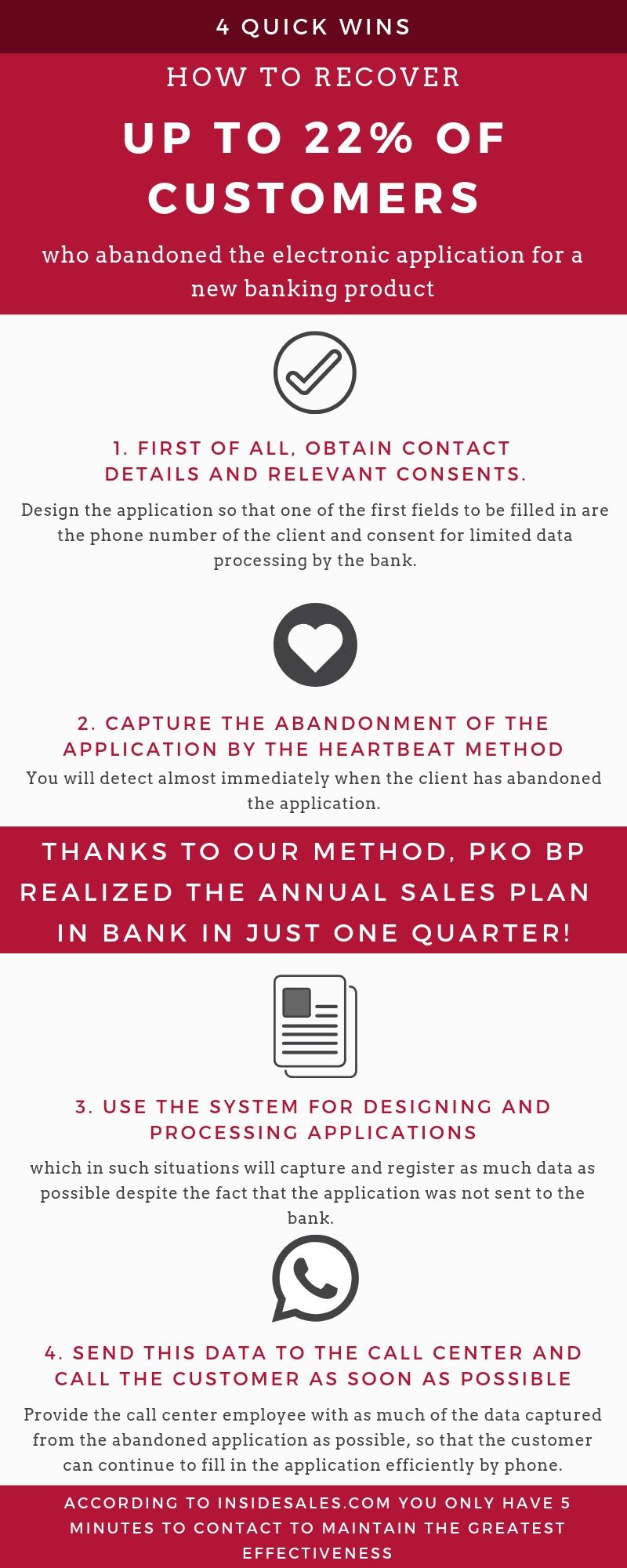

Read this article to the end and you will find out how you can recover up to 22% of customers who abandoned completing applications. It's worth it!

Banks are struggling with the lack of conversion

The conversion of an application is one of the most important measures of its effectiveness. It is the ratio of the number of opened applications to the number of finally submitted ones. Low conversion value means that the bank has problems with the application (of technical, business or UX nature), which discourage or prevent customers from filling it in.

Abandoning applications is not an exception, but a standard that is confirmed by research. Capgemini already in 2011 and 2012, in its regular World Retail Banking Report, determined that customers change banks primarily because of the quality of service and ease of use. In the 2018 report, another question was asked, but the conclusions are the same. It turned out that among the 5 factors that cause the wish to stay in the same bank for another year, the first place was "ease and convenience of use" and the fifth place was "convenience of using a website / mobile application". Just as in the case of staying in a bank, when choosing a new bank, customers first of all look at the ease and convenience of use.

Other studies directly concerned the filling in of online applications for banking products. OneSpan reported, according to Aite Group, that banks have a big problem with customers' abandonment of applications. Depending on the bank, from 65% to as much as 95% of customers abandon filling in applications. In another survey published at the beginning of 2019, Signicat asked respondents about the reasons why they abandoned applications. The results show that:

- The amount of personal information required (40%)

- The length of time it took to fill the forms in (34%)

- The fact I had to provide personal information by post or take it into the branch (28%)

- The language used was confusing (18%)

- Other (6%)

How to detect abandoned applications

From a technological point of view, banks can use at least two ways to identify an abandoned application. One of them (passive) is used more often, but it gives less chance of success of further conversion recovery process (you will read about the process in a moment). The second one, which we successfully apply to our clients, is a method that stands out for its high efficiency.

The passive detection of abandoned applications is to monitor user activity through server sessions. Beginning to fill in the form also starts the session on the server (for example, set to 20 minutes). It is nothing more than a timer, which after a drop to 00:00 makes the connection with the server terminated, identifying the application as abandoned. This means that for 20 minutes the user did not take any action. Each time the user moves to a new field in the application, it resets the timer and the time of 20 minutes starts running again.

The active method of detecting abandoned applications - heartbeat - provides better business results. The heartbeat mechanism takes its name literally from the principles of heart functioning, as an organ providing with its beating the life of other organs in the human body. The frequency of heartbeat can be checked regularly, so we know exactly when the next beat will occur. The same principle can be used for online applications. If we set the heart rate of the application e.g. every 5 seconds, it means that every 5 seconds the application will inform the server that it is still open. If the signal is not received within a predetermined period (e.g. 20 seconds), the application is considered abandoned because its heart has stopped beating.

The heartbeat mechanism in practice shortens the reaction time for abandoned application to a minimum. For the bank, the waiting time for receiving the signal is fully configurable so that it is possible to maximize the effects and minimize the risk of making mistakes (e.g. by a temporary loss of the Internet connection). In practice, heartbeat works perfectly well as an initial stage of the process of recovering conversions from lost applications.

Differences between abandoned applications

Before we move on to discussing an effective method for recovering conversions, we will first clarify one more point. It is important from the perspective of the processing of customers' personal data. In this case, it will be important to know whether the application was filled in by an existing customer or a new customer for the bank.

The first situation is when the customer, completing the application, is logged in to the bank's transaction system. In this situation, the case is made easier by the fact that the bank knows the customer, knows what products he has and also has all necessary contact details and consents.

The situation when the sales application is filled in by a non-authorized person is more difficult. The bank does not know the customer, and until the moment of filling in the application it did not have his data. However, even if the customer filled in his contact details in the form and only then abandoned the application, he could not yet approve the relevant consents entitling the bank to contact.

4 proven steps to increase conversion from abandoned applications

We now come to the most important part of this article, which is the proven recipe for how to increase conversion from abandoned applications. The primary goal of identifying a abandoned application is to contact the client as soon as possible once we have identified such a situation.

How to do this:

1. First of all, obtain contact details and relevant consents.

Design the application so that one of the first fields to be filled in is the phone number of the client. The number alone is not enough, so add a selectable consent for limited data processing by the bank to this field (e.g. 10 days for the purpose of contacting the bank). This is a simplified marketing consent.

2. Use the heartbeat method

in order to practically immediately identify a abandoned application.

3. Use the system for designing and processing applications,

which in such situations will capture and register as much data as possible despite the fact that the application was not sent to the bank. This will simplify and speed up the process of finalizing the application.

4. Integrate internal banking systems

so that the information about abandoning the application with the contact details goes immediately to the bank consultant (e.g. to the call center department), who will contact the customer by phone as soon as possible. Provide such an agent with as much of the data captured from the abandoned application as possible, so that the client can efficiently continue filling in the application by phone.

The method described above has already been successfully applied by our Clients. It is also confirmed by other global banks. Two such examples are mentioned by McKinsey in his publication Retail Banking Insights. What's more, it shares statistics of one of the leading banks in Asia-Pacific region. The bank effectively contacts more than 50% of those who have abandoned applications. The conversion from such calls amounts to as much as 43%. In other words, the bank recovers 22% of customers who have abandoned online applications!

The response time is crucial

Telephone contact should be made within a maximum of 10 minutes of the abandonment of the application, and ideally within 5 minutes! These are the next hard facts, this time from sales research. In 2011, a Lead Management Study survey showed that sales effectiveness drops by 400% if a call is not made to the customer within 10 minutes of the contact details being given. InsideSales.com confirmed this in its 2018 survey. From both sources it can be seen that the largest sales conversion will be achieved within the first 5 minutes. On the other hand, contact only after 30 minutes reduces the chances of sales already 21 times.

Think about how compatible the system of applications, identification of abandonments and transferring information to the call center must be to enable effective contact with the customer within 5 minutes from abandonment. So use the knowledge of experts in this field and contact us. We will be happy to help!